But the good news is that comprehensive ATM monitoring and management can help banks stay one step ahead of the threats.

By leveraging real-time monitoring solutions and proactive maintenance strategies, banks can:

- Mitigate increasing ATM security risks

- Ensure regulatory compliance

- Maximize ATM uptime and availability

- Enhance the customer experience

In this article, we'll dive into the top 8 data-driven reasons why robust ATM monitoring is no longer optional for banks - it's a necessity in today's high-risk landscape.

85% of ATMs Are Vulnerable to Attacks

ATMs are critical banking infrastructure that provide 24/7 cash access. Let it sink in:

- 85% of ATMs have major security flaws due to outdated software and hardware

- These vulnerabilities make ATMs prime targets for criminals

- ATM-related fraud attacks rose by 269% between 2019 and 2021*

- Over 91,000 cases of ATM skimming were reported worldwide in 2022

- Estimated global financial losses from these attacks reached approximately $150 million annually

* according to the CFCA’s Global Fraud Loss Survey 2023

ATMs are critical infrastructure for banks

Despite all the digital money trends and cashless transactions, ATMs (Automated Teller Machines) play a vital role in modern banking. Especially on the markets, where traditionally end-clients prefer extracting money when the salary hits the salary account.

ATMs allow customers to access cash and perform basic banking transactions 24 hours a day, 7 days a week, without needing to visit a physical bank branch. This convenience has made ATMs an essential service for millions of people worldwide.

For banks, ATMs are not only a key customer service point but also a significant revenue generator. Every time a customer uses an ATM, the bank typically charges a transaction fee.

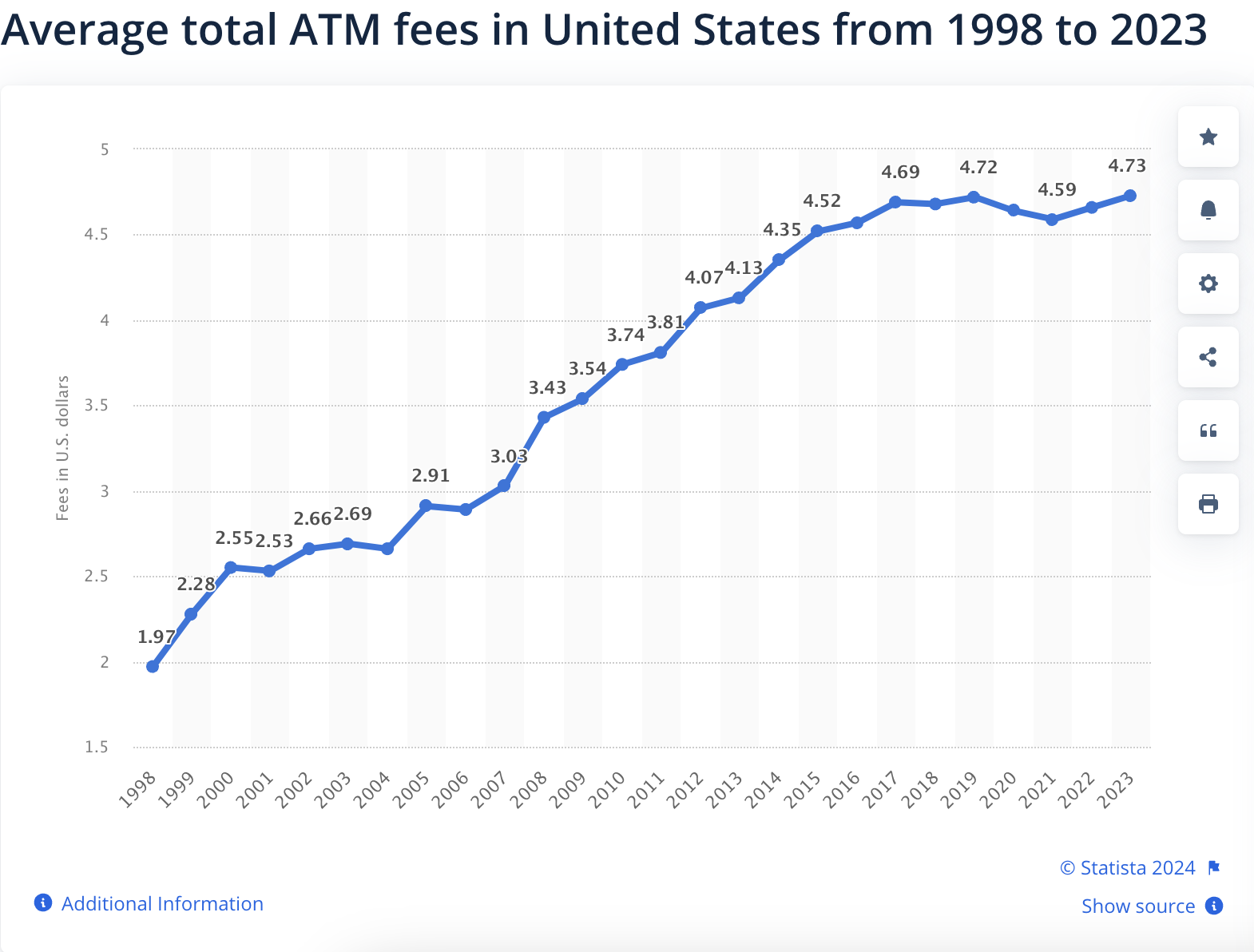

According to Statista, the average ATM fees charged by banks in the United States rose significantly between 1998 and 2023. In 1998, ATM fees were less than two U.S. dollars. After that, fees increased almost annually, reaching a record high of 4.73 U.S. dollars in 2023.

So, as you see, these fees can add up to substantial amounts, especially for banks with large ATM networks. ATMs also help banks reduce costs by automating many teller tasks, allowing them to serve customers with fewer staff and smaller branch footprints.

Vast majority of ATMs have tremendous security vulnerabilities

Despite their importance, a staggering 85% of ATMs are vulnerable to attacks. This is primarily due to outdated software and hardware that can be easily exploited by criminals.

Many ATMs still run on old, unsupported versions of Windows like XP or Windows 7. These operating systems no longer receive security updates from Microsoft, leaving them exposed to known vulnerabilities. Hackers can use these flaws to break into ATMs and install malware that steals customer data or dispenses cash.

“We are often asked, if NetXMS ATM monitoring works on ATMs with Windows XP or Windows 7. And for us it is important to note that yes, it does! Vast ATM fleets usually have machines of different age and caliber, and we try to always accommodate our clients’ requests.”

Victor Kirhenshtein, the CEO of NetXMS

ATM hardware vulnerabilities

ATM hardware is also a weak point. Criminals physically tamper with ATMs to install card skimmers that steal customer card data and PINs.

They can also exploit USB ports or network interfaces to access the ATM's internal systems.

ATMs are prime targets for criminals

According to the CFCA’s Global Fraud Loss Survey 2023, in 2023, there were over 18,000 physical attacks on ATMs globally. In a criminal’s eye ATM attacks can be highly lucrative.

In just a matter of minutes, a successful attack can net thieves thousands of dollars in cash. And the combination of lax security and the promise of quick cash makes ATMs a very appealing target.

Beyond simple theft, compromised ATMs can also be used for more sophisticated crimes like money laundering or identity theft.

Criminals can use stolen card data to create cloned cards and drain accounts. They can also sell this data on the dark web to other fraudsters.

Why are ATMs important?

So why are ATMs still so important in the digital age? Despite the rise of online and mobile banking, many people still rely on ATMs for their daily cash needs.

This is especially true in developing countries where access to traditional banking services may be limited.

ATMs also provide a vital lifeline during emergencies or natural disasters when power outages or network disruptions can make digital payments impossible. Having access to physical cash can be critical in these situations.

From a social perspective, ATMs have helped democratize access to banking services. They've allowed people in remote or underserved areas to access their money without having to travel long distances to a bank branch.

However, for ATMs to continue playing this important societal role, their glaring security issues must be addressed. The high prevalence of vulnerabilities is unacceptable given the critical nature of these machines.

In the next section, we'll explore the top reasons why banks must make ATM security a much higher priority.

Top Reasons Banks Must Improve ATM Monitoring & Management

As ATM attacks and vulnerabilities are on the rise, putting banks and customers at risk, robust real time monitoring and remote management is crucial for security, compliance, and customer satisfaction.

Proactive measures can prevent costly breaches, outages, and inefficiencies.

As ATM networks become increasingly complex and targeted by sophisticated criminals, the need for banks to bolster their monitoring and management capabilities has never been more critical.

In this section, we'll explore the top 8 reasons why banks must prioritize ATM monitoring and management to safeguard their assets, customers, and reputation.

1. Mitigate Increasing ATM Security Risks

ATM attacks have evolved far beyond the days of simple card skimming. Today's criminals employ advanced tactics like malware injection, network hacking, and physical attacks to compromise ATMs and steal cash or sensitive data.

In 2020 alone, the European Association for Secure Transactions (EAST) reported 4,578 ATM logical attacks, a 44% increase from the previous year.

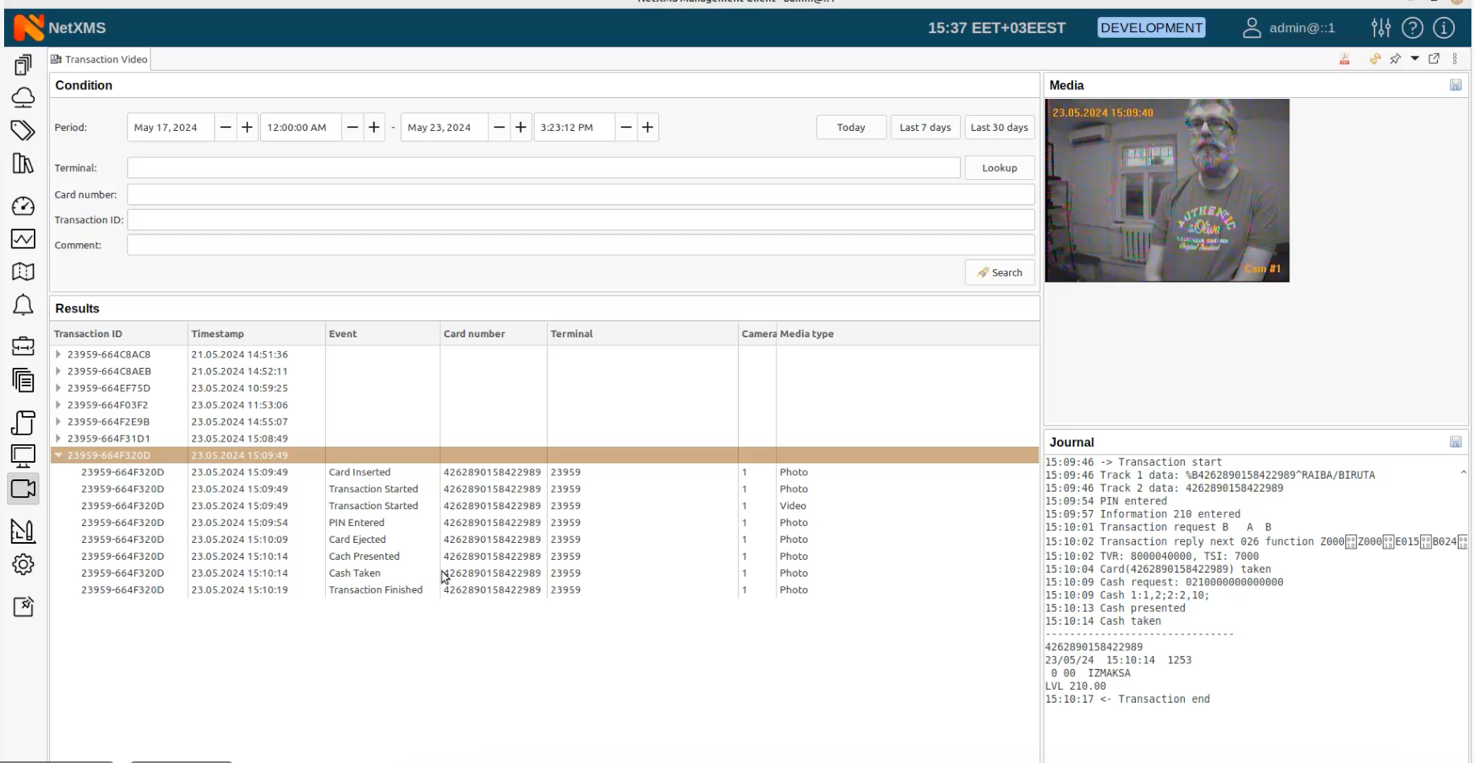

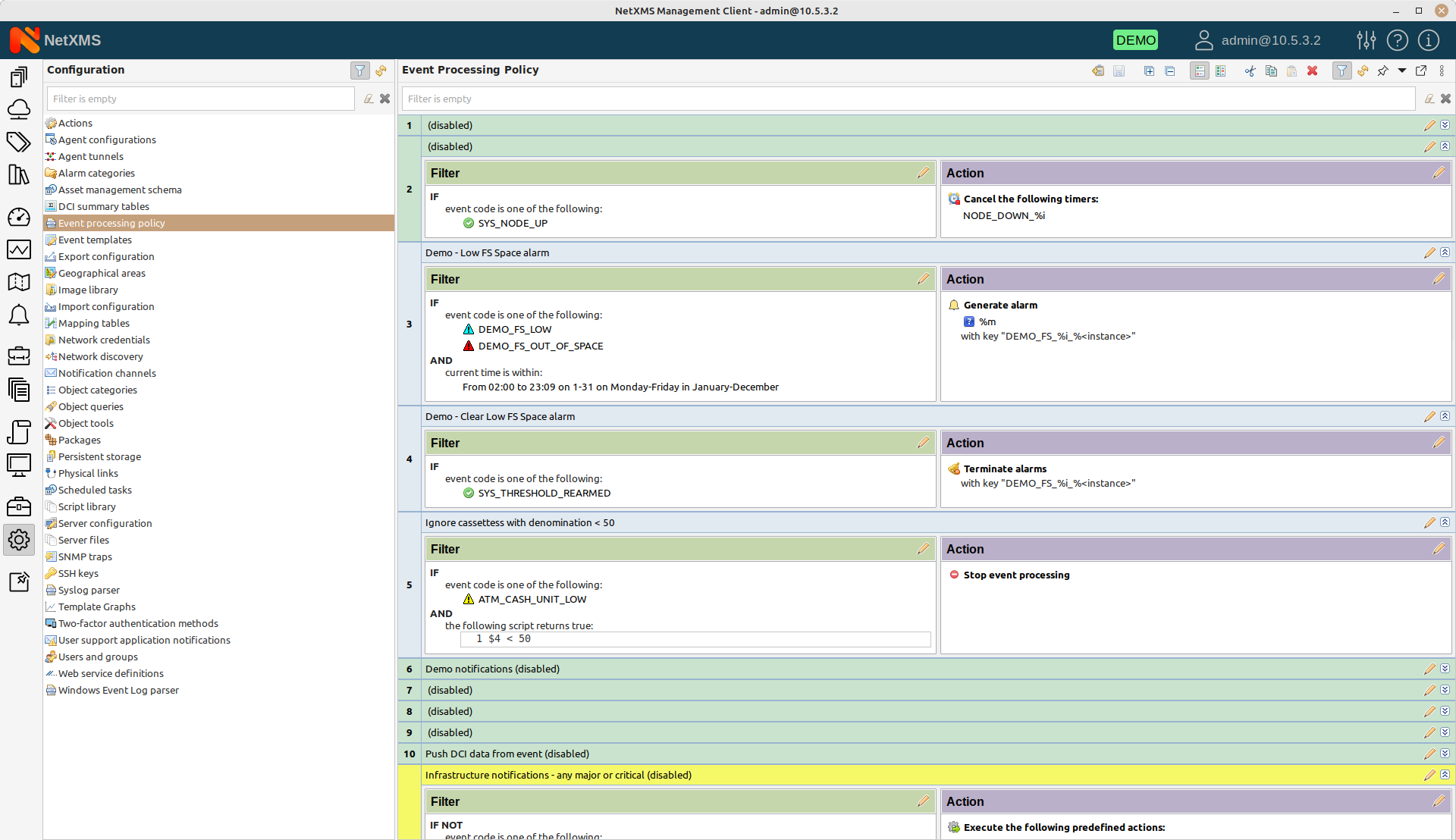

Real-time monitoring is essential for detecting and responding to these threats before they escalate. Advanced solutions use machine learning to identify anomalous behavior, such as unusual cash withdrawals or system changes, and alert security teams for immediate investigation.

By proactively monitoring for signs of attack, banks can prevent breaches, minimize losses, and protect their customers' trust.

“With the NetXMS ATM monitoring system we explore new possibilities, brought by ML — introducing anomaly detection. Although monitoring system’s main task is to focus on ATM’s health, monitoring of its operations and remote management, it’s important to see how this functionality can also be used to spot suspicious activities and prevent fraud.”

Case Study: Cosmos Bank ATM Heist

In 2018, hackers infiltrated the ATM server of India's Cosmos Bank and stole $13.5 million in just two hours.

The attackers used malware to bypass the ATM withdrawal limits and move money to foreign accounts. This sophisticated attack highlights the importance of robust monitoring to detect and block suspicious activity in real-time.

2. Identify and Patch ATM Network Vulnerabilities

ATMs rely on complex network infrastructure to communicate with banks' core systems. However, these networks often have inherent vulnerabilities that criminals can exploit to gain unauthorized access.

Common weaknesses include unsecured wireless connections, outdated software, and unpatched operating systems.

Regular vulnerability scanning is crucial for identifying and remediating these weaknesses before they can be exploited.

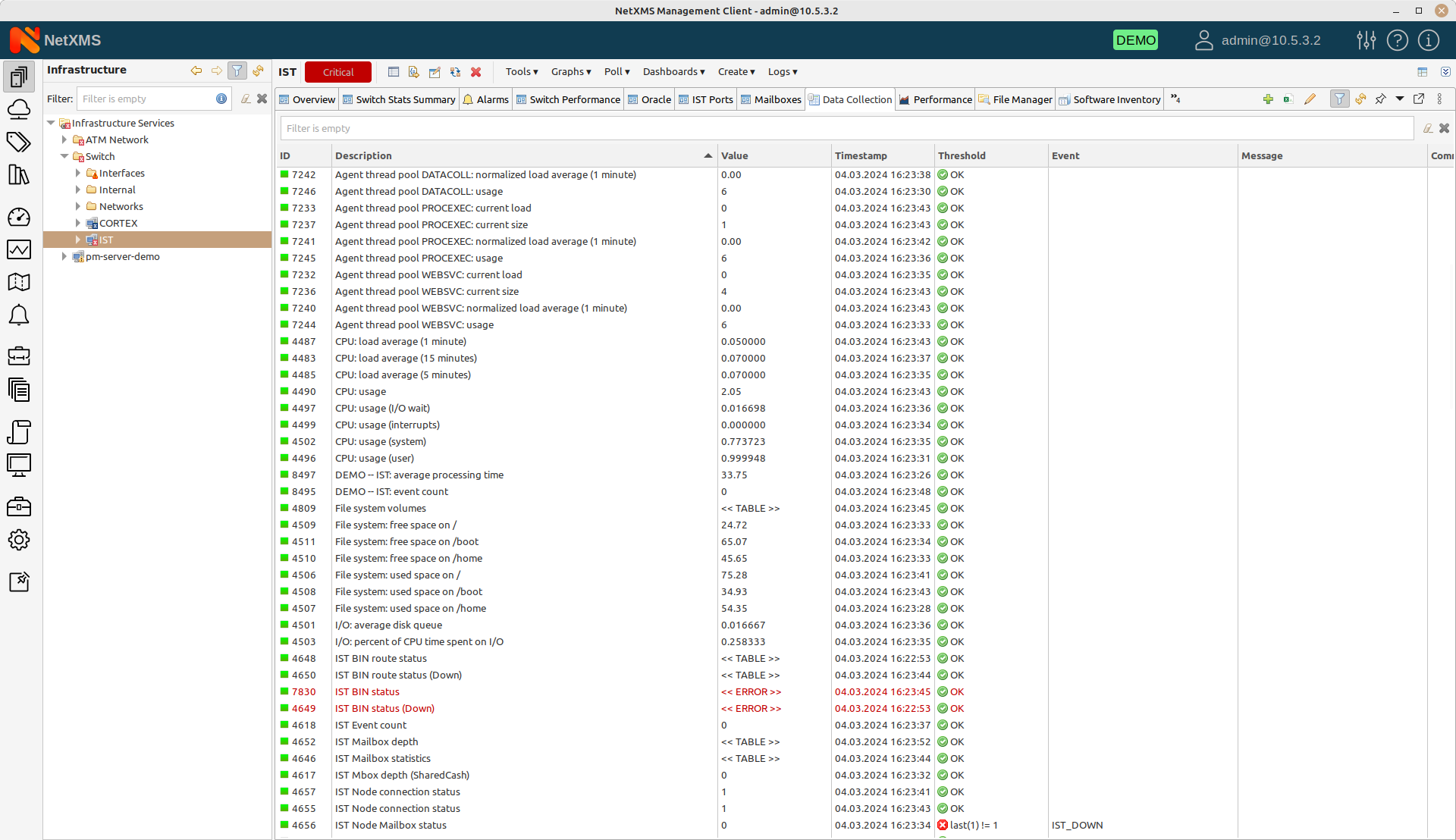

Automated tools can continuously monitor ATM networks for known vulnerabilities, configuration errors, and compliance gaps.

Patch management processes ensure that software updates and security patches are promptly applied to all ATMs to close any potential entry points for attackers.

3. Ensure Regulatory Compliance

Banks face an ever-growing list of regulations and industry standards designed to protect consumer data and prevent financial crimes. Failure to comply can result in hefty fines, reputational damage, and even criminal charges.

For example, the Payment Card Industry Data Security Standard (PCI DSS) requires banks to implement strict security controls for ATMs that process card payments.

These include encrypting cardholder data, restricting physical access to ATMs, and regularly testing security systems.

“NetXMS system works only with encrypted data — cardholders’ data is not received by the system. Our clients successfully certified their NetXMS ATM monitoring on-premise installations, receiving PCI DSS certifications.”

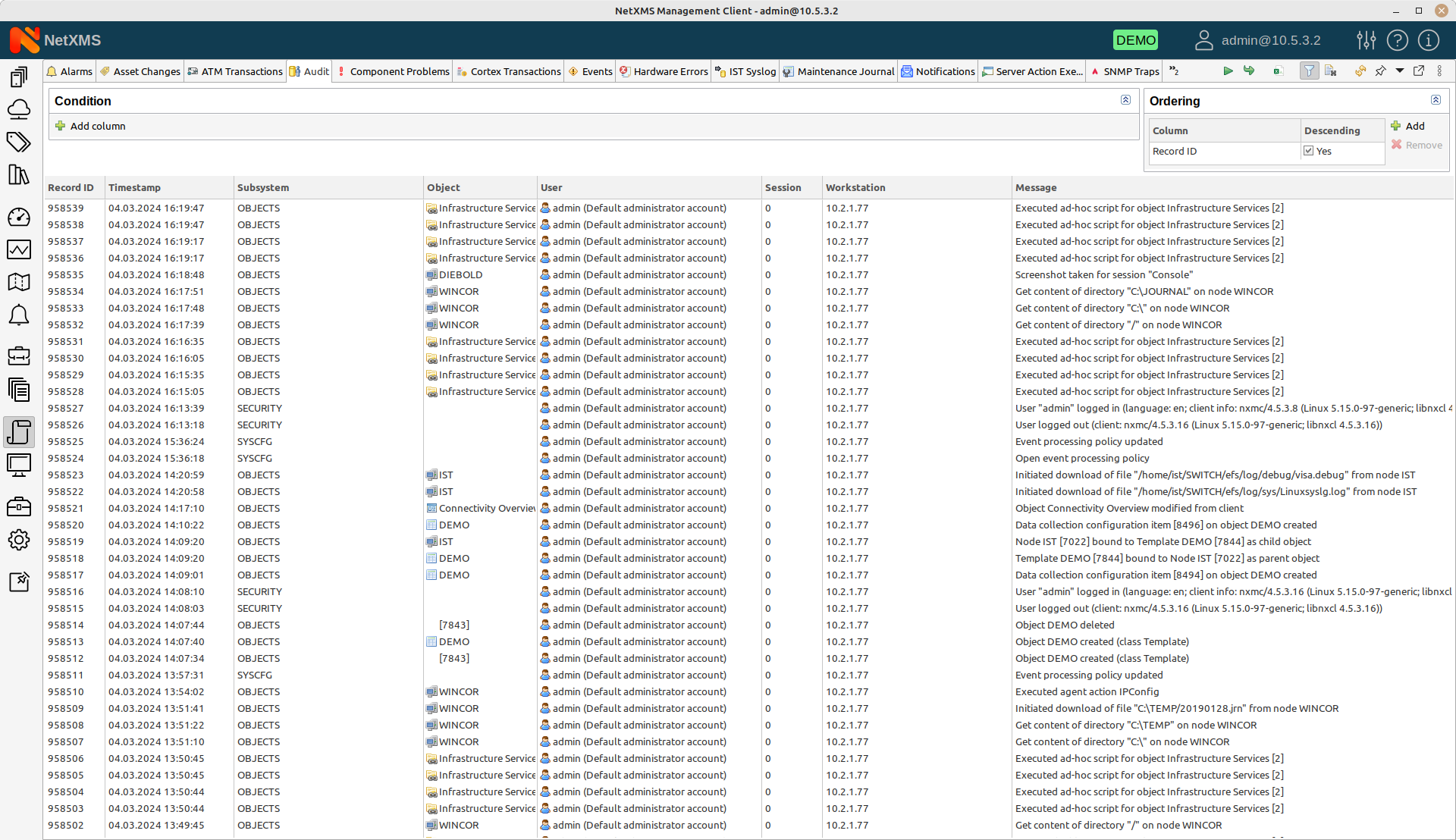

Comprehensive ATM monitoring helps banks demonstrate compliance by providing detailed audit trails and real-time alerts for any deviations from established policies.

4. Protect Sensitive Customer Data

ATMs handle some of customers' most sensitive personal and financial data, including card numbers, PINs, and account balances. A single data breach can expose this information to criminals, leading to identity theft, fraudulent transactions, and long-term damage to customer trust.

End-to-end encryption is essential for protecting data as it travels between ATMs and bank systems. Monitoring solutions should track encryption status and alert on any lapses or anomalies.

Access controls, both physical and logical, ensure that only authorized personnel can interact with ATM components and data.

By closely monitoring data handling and implementing layered security, banks can uphold their responsibility to safeguard customer information.

5. Maximize ATM Uptime and Availability

For many customers, ATMs are their primary touchpoint with their bank. They expect 24/7 access to cash and account services. ATM outages not only inconvenience customers but also result in lost transaction revenue for banks.

According to a 2019 CR2 study, ATM downtime costs banks an average of $14,800 per hour in lost fees and customer trust.

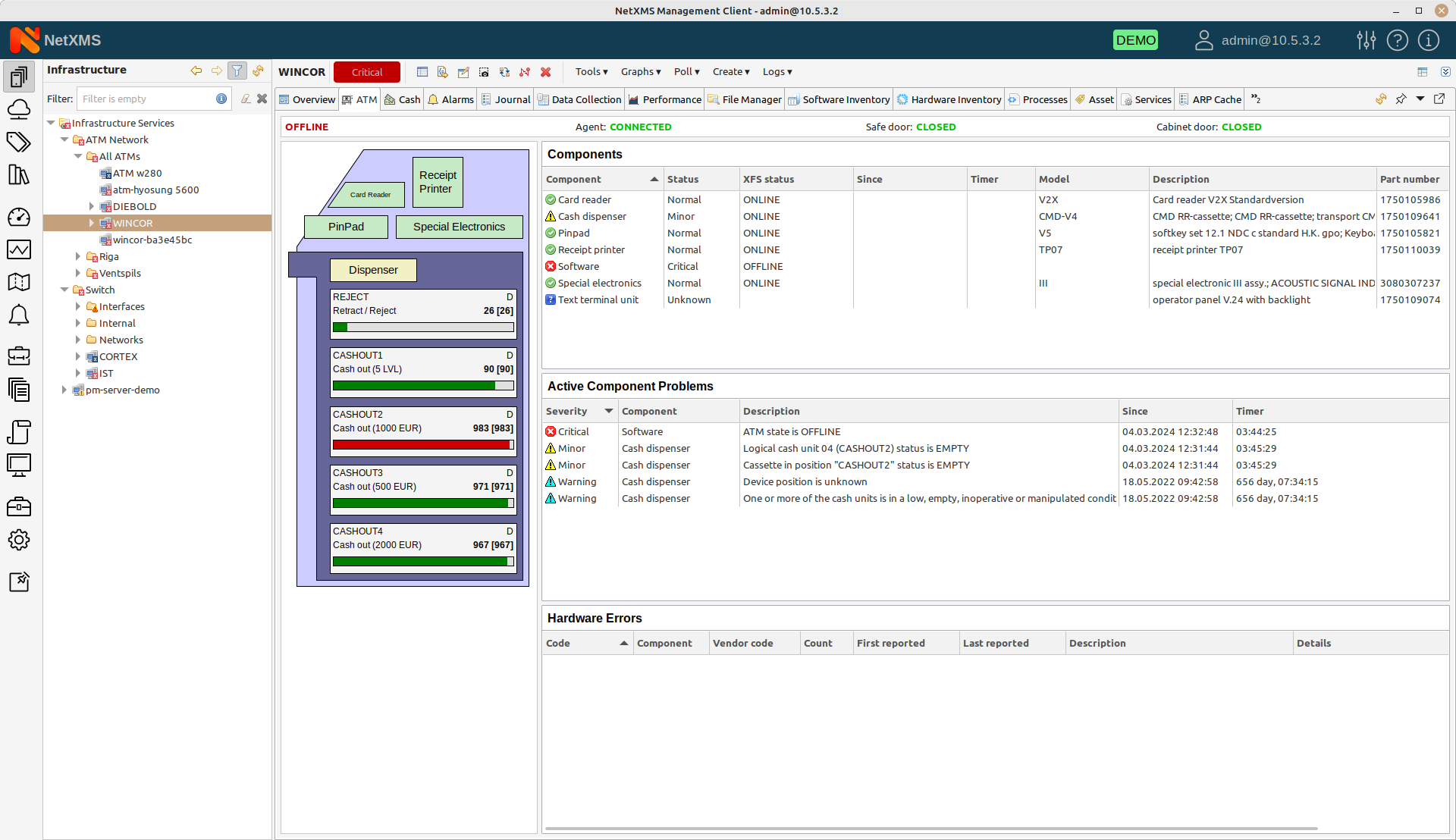

Monitoring ATM performance metrics like hardware health, network connectivity, and cash levels enables banks to proactively identify and resolve issues before they impact customers.

By optimizing ATM uptime, banks can ensure reliable service delivery and customer satisfaction.

6. Optimize Cash Management

Efficient cash management is critical for minimizing ATM operating costs and ensuring cash is always available when customers need it. Running out of cash frustrates customers, while overstocking ties up working capital and increases the risk of theft.

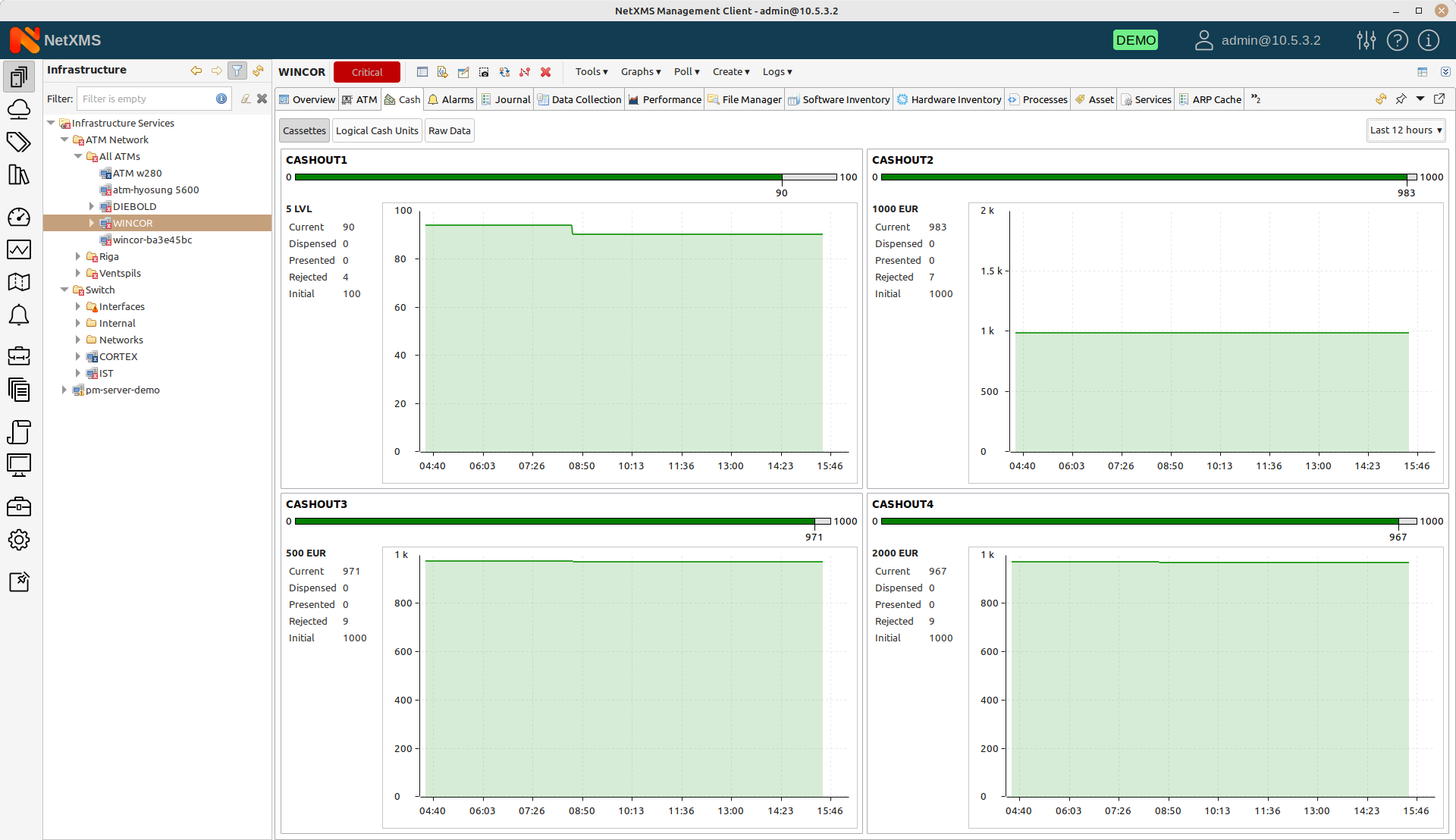

Monitoring real-time cash levels and usage trends enables banks to forecast demand and optimize replenishment schedules.

Intelligent algorithms can predict cash needs based on historical data, seasonal fluctuations, and external events.

This data-driven approach reduces the frequency of costly emergency cash deliveries and ensures that ATMs are stocked with the optimal mix of denominations.

7. Enhance Customer Experience

In today's competitive banking landscape, customer experience is a key differentiator. ATMs play a central role in shaping customers' perceptions of their bank's service quality and convenience. Long wait times, confusing interfaces, and transaction failures can quickly sour customer relationships.

Monitoring ATM performance and availability enables banks to proactively identify and resolve issues that impact the customer experience.

For example, detecting a high volume of declined transactions at a specific ATM may indicate a problem with the card reader or cash dispenser.

By promptly dispatching maintenance based on real-time status monitoring, banks can minimize customer frustration and maintain a seamless experience across their ATM network.

8. Gain Operational Visibility

Managing a vast network of ATMs across diverse geographies is a complex undertaking. Without end-to-end visibility, banks struggle to identify systemic issues, optimize resource allocation, and make data-driven strategic decisions.

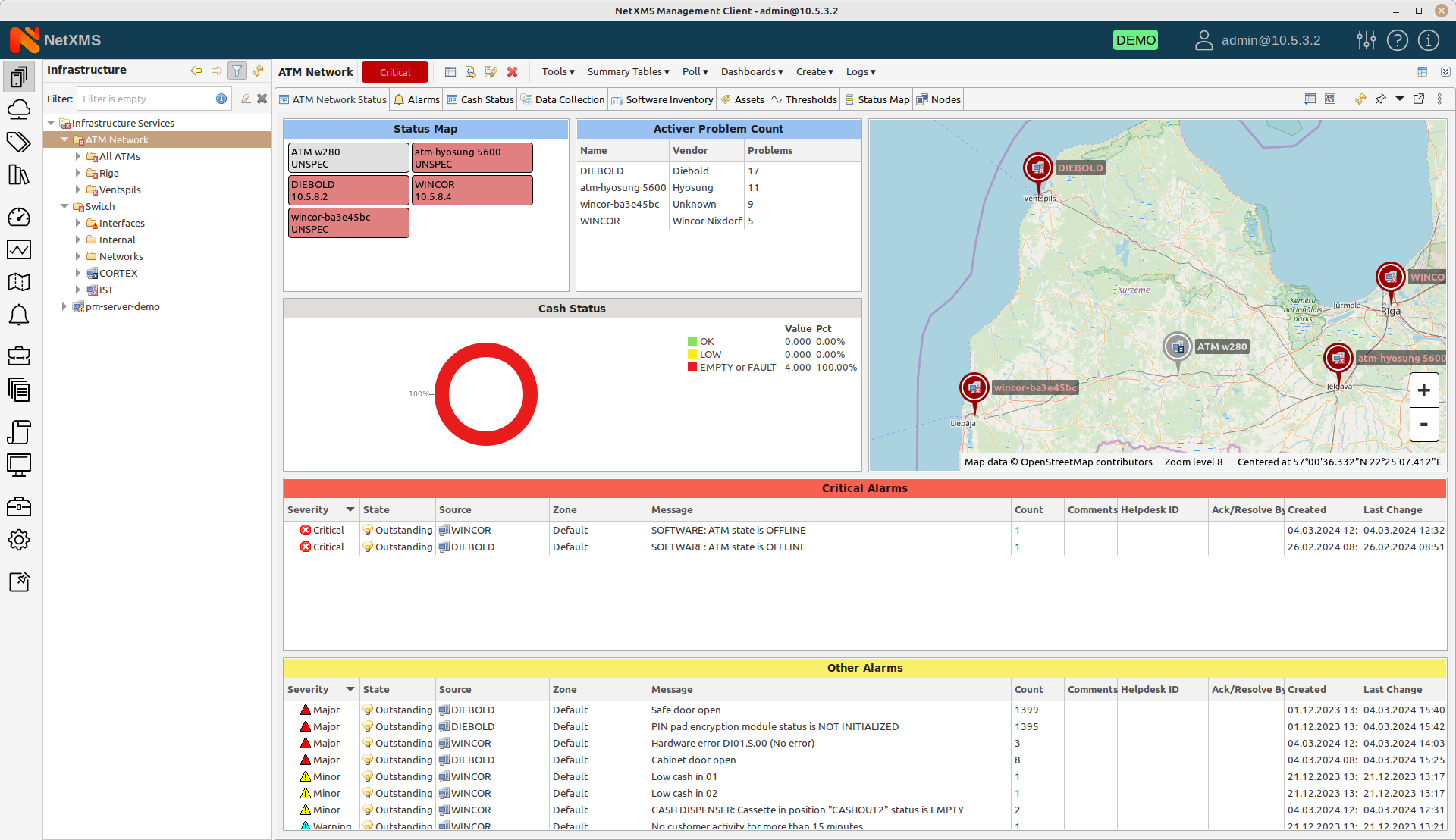

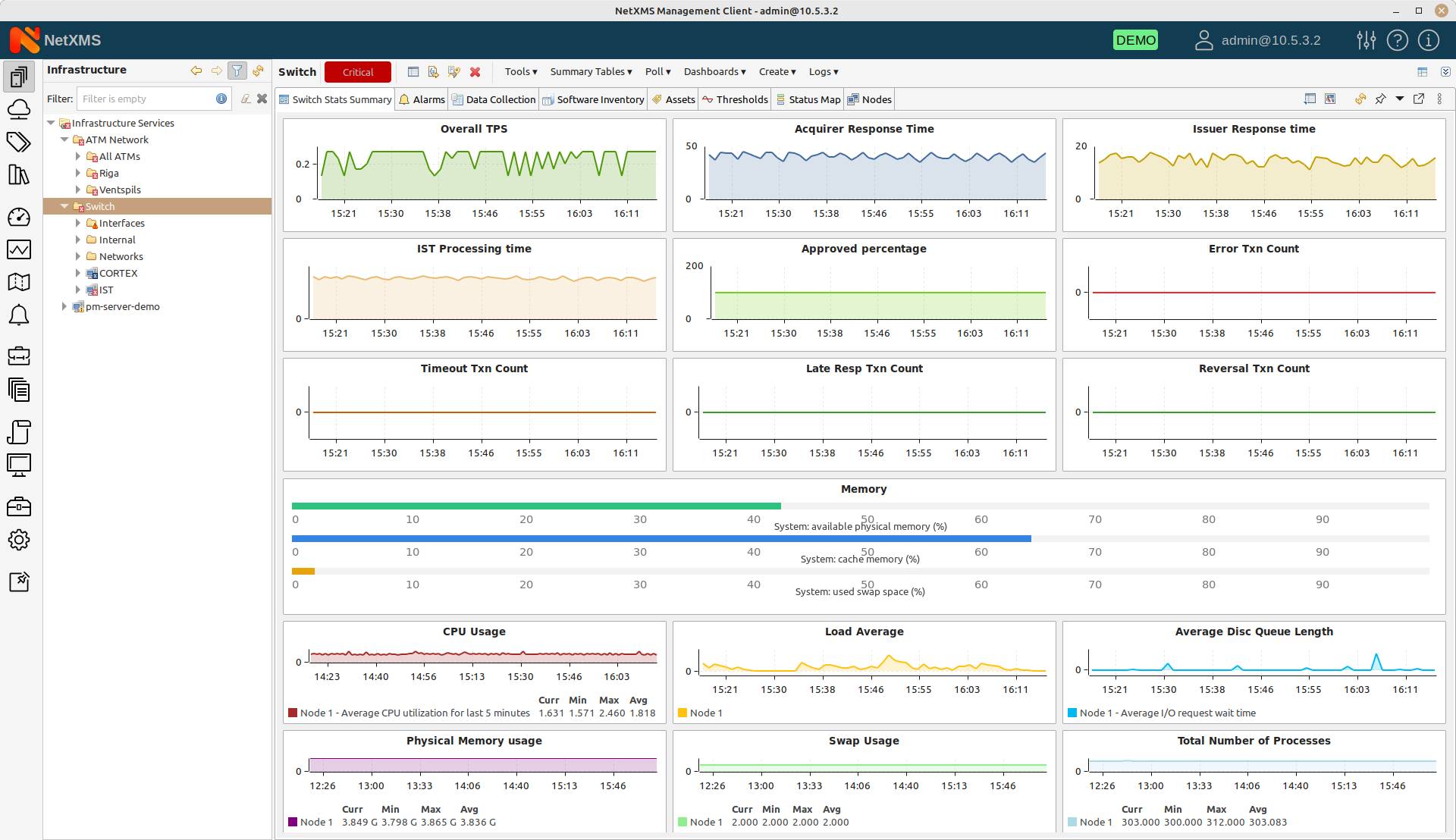

Centralized ATM monitoring solutions provide a unified view of the entire fleet, consolidating data from multiple sensors and systems into actionable dashboards.

This holistic visibility enables banks to track key performance metrics, identify trends, and benchmark individual ATMs against the broader network.

Armed with these insights, operations teams can drive continuous improvement initiatives and make informed decisions to enhance security, efficiency, and profitability.

As we've seen, the stakes for ATM security and performance have never been higher. By prioritizing comprehensive monitoring and management, banks can proactively mitigate risks, ensure regulatory compliance, and deliver the seamless experience customers expect.

In the next section, we'll take a closer look at how an effective ATM monitoring and management system works and the key components banks should look for when evaluating solutions.

How Comprehensive ATM Monitoring & Management Works

Real-time monitoring detects issues before they cause downtime. Proactive maintenance keeps ATMs secure and operational and advanced analytics optimize cash management and customer experience.

Real-Time ATM Monitoring Solutions

Real-time ATM monitoring is the foundation of a comprehensive management strategy. As Diebold Nixdorf's VP of Managed Services, Richard Harris, explains, "Continuous monitoring is essential for detecting and responding to potential threats or operational issues before they impact customers."

Advanced monitoring systems track key metrics like ATM health status, cash levels, and transaction history 24/7.

If an issue arises, such as a hardware malfunction or suspicious activity, alerts are instantly sent to the appropriate personnel. This allows banks to proactively address problems and minimize downtime.

According to a 2021 report by ATM Marketplace, 68% of financial institutions cite real-time monitoring as a top priority for improving ATM operations.

The ability to remotely diagnose and often resolve issues dramatically reduces costs associated with on-site technician visits.

Customizable Alert Thresholds

Flexible alert thresholds are another key feature of effective monitoring solutions. Banks can set custom parameters for factors like low cash levels, excessive transaction declines, or device errors.

This ensures that the right staff are notified at the right time to take corrective action.

As Jeff Dudash from NCR states, "Customizable alerting empowers our clients to define their own business rules and immediately identify situations that require attention."

By fine-tuning alert sensitivity, banks can strike the optimal balance between proactive maintenance and efficient resource allocation.

Proactive ATM Maintenance Strategies

While real-time monitoring is crucial, it's only one component of comprehensive ATM management. Proactive maintenance strategies use advanced data analytics to predict and prevent failures before they occur.

ATM performance data, such as transaction volume, error codes, and cash dispensing metrics, can reveal valuable insights.

Sophisticated algorithms analyze this data to identify patterns that may indicate an impending failure, such as steadily increasing card read errors or unusual cash dispensing behavior.

Armed with these predictive insights, banks can optimize their maintenance schedules and resource allocation.

Instead of waiting for an ATM to fail, technicians can be dispatched to proactively service the machine, replace worn parts, and replenish supplies. This approach maximizes uptime and improves the customer experience.

Streamlined Maintenance Workflows

Optimized maintenance workflows are essential for maximizing technician efficiency. Leading ATM management solutions integrate with work order management systems to automatically generate and assign tickets based on predictive insights or real-time alerts.

“NetXMS ATM monitoring and management system boasts rich API and easily integrates in bank’s existing infrastructure.”

This streamlined approach ensures that the right technician with the right skills and parts is dispatched to the right location at the right time.

By minimizing transit times and improving first-time fix rates, banks can significantly reduce maintenance costs while improving ATM availability.

As the ATM Industry Association notes in their 2022 Best Practices Guide, "Efficient maintenance workflows are a critical component of a successful ATM management strategy. By integrating comprehensive real-time monitoring system, banks can achieve unparalleled levels of ATM uptime and operational efficiency."